Admiral Markets Review

Admiral Markets Review

| Min. Deposit100$ | Demo AccountYes |

- Rating

- Open multiple accounts in multiple currencies

- Transfer funds from account to account

- Wide range of educational resources

- Customer support in multiple languages

- Four offices in different parts of the world

Launched in 2001, Admiral Markets is an online broker that offers a sophisticated platform for metals and currency trading and CFD trading on indices, energies, and stocks. It features top trading condition, flexible accounts and high-speed trade execution.

Here are the top selling points of Admiral Markets:

-

Flexible Trading Accounts – Clients can make deposits in their home currencies and the broker converts them in applicable currencies such as CHF, EUR, USD, and GBP. Traders can also protect their capital from currency fluctuation by simultaneously maintaining multiple accounts in multiple currencies. Clients can transfer funds from one account to the other through an internal transfer system in the Trader’s Room.

-

Education and Analytics – To help its clients make the best trading decisions, the broker offers a number of educational resources, including seminars and webinars. Admiral Markets also publishes educational brochures and books in multiple languages and distributes them to clients worldwide. Moreover, it is continuously expanding its collection of educational resources.

-

Customer Support – Admiral Markets offers excellent multi-lingual customer support through live chat and phone. You can also send an email to [email protected].

-

Software and Security – Admiral Markets’ servers are located close to major providers of liquidity so that it can offer the lowest latency and the best execution. Traders can also choose from sophisticated trading platforms such as MT5 and MT4, developed by MetaQuotes Software Corp, a leading provider of trading software.

Is This Online Broker Reliable?

The Admiral Markets Group comprises the following companies:

-

Admiral Markets Pty Ltd – Regulated by the Australian Securities and Investments Commission (ASIC), this firm offers protection against market volatility, negative account balance policy, and leverage of up to 1:500 for all retail clients.

-

Admiral Markets UK Ltd – Regulated by the Financial Conduct Authority (FCA) of the UK, this company offers FSCS protection, negative balance protection, and leverage of up to 1:30 for retail clients and 1:500 for professional clients.

-

Admiral Markets AS – Regulated by the Estonian Financial Supervision Authority (EFSA), this company offers a guarantee fund, negative balance protection, and leverage of up to 1:30 for retail clients and 1:500 for professional clients.

-

Admiral Markets Cyprus Ltd – Regulated by the Cyprus Securities and Exchange Commission (CySEC), this company offers ICF protection, negative balance protection, and leverage of up to 1:30 for retail clients and 1:500 for professional clients.

Admiral Markets offers excellent financial security by implementing the following measures:

-

Segregation of Funds – Admiral Markets complies with CySEC regulations and maintains client funds separately. It never mixes clients’ money with its own assets. This ensures that clients have access to their money at all times.

-

Investor Compensation Fund (ICF) – Admiral Markets has protected client funds from any risk of financial difficulties in future. Each covered client is protected up to EUR20,000 through the ICF.

-

Negative Balance Protection – Admiral Markets has a negative balance protection policy for its professional clients, according to which it offers protection of up to EUR50,000 per client against account deficits. Retail clients can enjoy complete, unconditional negative balance protection without any max payout limits.

Admiral Markets Facts and Figures 2026

| Instruments | 8000+ Forex, Stocks, Commodities, Cryptocurrencies, Indices, ETFs, Bonds. |

| Licenses and Regulation | (FCA) U.K., EFSA, (MiFID) European Economic Area, JSC, (AFSL) Australia, (CySEC) Cyprus. |

| Demo Account | Yes |

| Islamic Accounts | Yes |

| Trading Platforms | MetaTrader 4/5, MetaTeader WebTrader, Admirals Mobile App, StereoTrader. |

| Minimum Deposit | $100 |

| Accounts | Over 120,000 clients worldwide. |

| Customer Support | Phone, Email, Live Chat, Facebook, Telegram, FAQ. |

| Funding & Withdrawal | Bank Transfer, Visa, MasterCard, Skrill, Klarma. |

Open an Account and Start Trading

When it comes to account creation at Admiral Markets, clients can open a live account or a demo account. The following are the steps to get started:

-

Step #1: Create a Trader’s Room account. The Trader’s Room is a personal account management system that enables clients to create live and demo trading accounts, make deposits, request payouts, and a lot more.

-

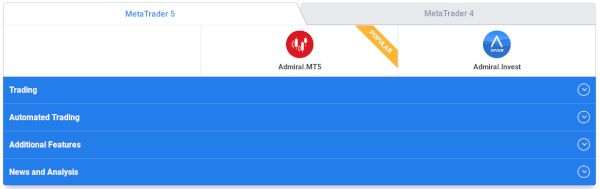

Step #2: Select a trading platform. Clients can either download the MT4 or MT5 platforms or trade on their browser through the WebTrader or MetaTrader platforms.

-

Step #3: Login and start trading. Clients can either practice on a demo account without risking their money or make a deposit and start trading for real.

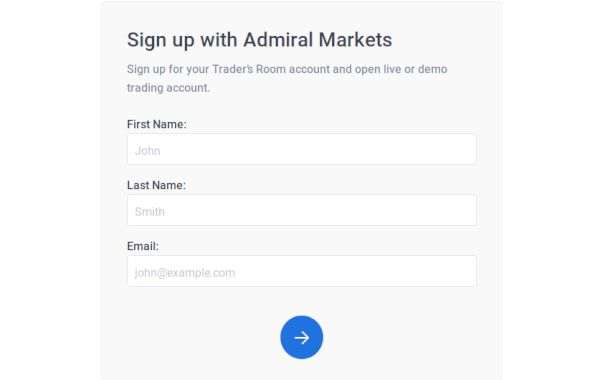

To sign up for their Trader’s Room account and open a demo or a live trading account, clients have to first click on the green Create Account button on the Admiral Markets website. Doing so opens a simple online registration form, in which customers have to input their name and email address.

Then they have to verify their email address by clicking on a link in the Forex broker’s welcome email. The rest of the registration procedure can be completed only after verifying the email address.

Types of Accounts

Admiral Markets offers the following types of accounts, each associated with its own set of services and features. Traders can choose an account type that best suits their requirements, trading style, and trading goals.

Admiral.Markets

This is the most popular type of account at Admiral Markets. Here are the main features of this type of account:

-

Minimum deposit US$100

-

Trade 45 currencies, 3 spot metal CFDs, 3 spot energy CFDs, 3 index futures CFDs, 64 stock CFDs, and 2 bonds CFDs.

-

Leverage in the range of 1:30 to 1:20 for retail clients and 1:500 to 1:10 for professional clients

-

Spreads that start from 0.5

-

No commission

Admiral.Prime

The following are the main features of this account:

-

Minimum deposit US$100

-

Trade 45 currencies, 3 spot metal CFDs, 10 cash index CFDs, and 3 spot energy CFDs

-

Leverage of 1:30 to 1:20 for retail clients and 1:500 to 1:10 for professional clients

-

Spreads start from 0

Admiral.MT5

The chief features of this type of account are:

-

Minimum deposit US$100

-

Trade 45 currencies, 3 spot metal CFDs, 7 spot agriculture CFDs, 3 index futures CFDs, 10 cash index CFDs, 3000+ stock CFDs, 300+ ETF CFDs, and 2 bonds CFDs

-

Leverage in the range of 1:30 to 1:20 for retail clients and 1:500 to 1:10 for professional clients

-

Spread starting from 0.5 pip

Admiral Markets Pro

You can be a professional client of Admiral Markets if you are eligible for it. You can check for eligibility on its official website. The FX broker has more than 120,000 professional clients at the time of writing.

As a professional client, you can enjoy the following benefits:

-

High leverage

-

High risk trading strategies with greater rewards

-

Cash rebates on trades

-

Access to all discounts, incentives, and rewards

-

Early access to extra services and new products

To become an Admiral Markets Pro, traders have to make at least ten good-sized transactions per quarter during the last year, have a financial instruments portfolio exceeding EUR500,000, and experience working in the financial sector for a minimum of one year.

Demo Account

Demo accounts are for customers who are not yet ready to trade for real. Traders can use demo accounts to sharpen skills, learn more about trading, or test new trading strategies.

A demo account comes with the following features:

-

30-day validity

-

Quick start guide

-

Free real-time news and market data

-

Live market experience

-

Trade on all devices

Trading Platforms

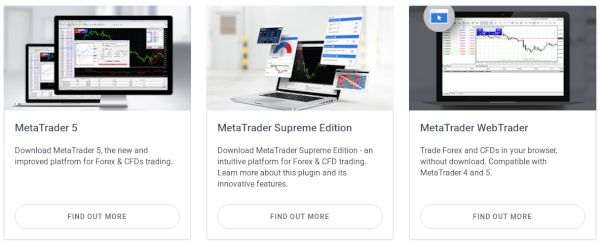

Clients can choose from the following trading options according to their trading requirements:

MetaTrader 5 for Windows

MT5 is a sophisticated multi-asset trading platform, which is popular among investors and traders from different parts of the world. This platform features advanced trading and charting tools and also enables automated trading.

Traders can download MT5 for windows or trade in their browser with MT5 WebTrader.

MetaTrader Supreme Edition

This platform can boost your trading experience in ways unimaginable. The MT4 as well as MT5 Supreme Edition is available for demo as well as live trading accounts.

They come with features such as global opinion widgets, mini terminals, trade terminals, tick chart traders, real-time news, indicator package, trading simulator, and mini chart.

MetaTrader WebTrader

The WebTrader platform requires no download and is compatible with all operating systems. Traders can choose from the MT4 WebTrader or the MT5 WebTrader.

MetaTrader 4 for Windows

You can just download this trading platform for Windows and enjoy the following features:

-

100% security and flexibility

-

User friendly interface

-

Support for multiple languages

-

Options for automated trading

-

Fully customizable

-

Sophisticated charting capabilities

Financial Markets

While Admiral Markets Cyprus Ltd and Admiral Markets Pty Ltd offer only CFD trading, Admiral Markets AS and Admiral Markets UK Ltd offer trading products such as ETFs, CFDs, and shares.

Clients trading with the Cyprus and Australia offices can choose from 3000+ markets, including indices, shares, commodities, ETFs, and forex. Clients trading with the UK and Estonia offices can choose from 7500+ markets, including indices, forex, shares, crypto, ETFs, and commodities.

Margin Requirements

Admiral Markets offers a limited leverage and retail trading terms by default. Customers then have the option of accessing higher leverage categorizing themselves as professional clients through their Trader’s Room.

Retail clients can enjoy the following leverage:

-

1:30 for major currency pairs and major cross rates

-

1:20 for all other currency pairs, precious metals, and indices

-

1:10 for commodity and index CFDs

-

1:5 for ETFs, bonds, and stock CFDs

-

1:2 for cryptocurrency CFDs

Retail and Professional Trading Terms

Here is a list of trade offs and benefits of retail trading terms:

-

Negative balance protection

-

Reduced leverage

-

No bonus programs

-

Strong regulatory protection

The following are the trade offs and benefits of professional trading terms:

-

Increased leverage

-

Complete access to all bonus programs

-

Professional communication

-

New product promotions without risk warnings

-

Limited Negative balance protection

Volatility Protection

Admiral Markets has advanced settings to help clients reduce risks associated with market volatility. These settings enable traders to:

-

Limit max price slippage on stop orders

-

Avoid or limit loss on pending orders that fall within price gaps

-

Enable partial fills

-

Execute take profits and limit orders in case of instant price spikes

-

Avoid activation of orders because of widening of spreads

Get Educated

Admiral Markets can teach and train you irrespective of whether you are a beginner who wants to get started or an experienced trader who wants to know more.

Choose from the following educational resources at Admiral Markets:

-

Webinars

-

CFD & Forex Seminars

-

Frequently Asked Questions (FAQ)

-

Glossary

-

Tutorials and Articles

-

Forex 101 – The Forex and CFD Trading Course

Deposits and Withdrawals

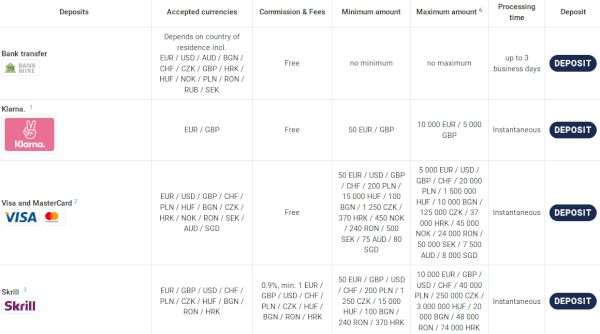

Customers can use the following methods to instantly deposit funds in their trading accounts:

-

Bank Transfer – Using bank transfer for making deposits is free, but the money takes three days to arrive into your account.

-

MasterCard & Visa – These are free and instant deposit options.

-

Skrill – Skrill transfers are charged 0.9% to a minimum of USD/EUR1.

-

Account-to-account Transfer – Transfers between accounts in the same currency are free, but transfers between different currency accounts are charged 1% of the transferred amount.

You can make withdrawals using the following methods:

-

Bank Transfer – You can make two free bank transfer withdrawals every month. The processing time is three days.

-

Skrill – Each Skrill withdrawal costs 1% to a minimum of EUR/USD1. You can withdraw a minimum of USD/EUR1 to a maximum of EUR/USD10,000. Skrill withdrawals are instant.

FAQ

Which trading platforms are supported by Admiral Markets?

MetaTrader 4/5, MetaTeader WebTrader, Admirals Mobile App, StereoTrader.

What is the minimum deposit required to open an account with Admiral Markets?

100 USD.

Final Thoughts on Admiral Markets

We feel that you should check out Admiral Markets because they have ample industry experience. Moreover, they are highly reputed, licensed, and well-regulated. There are plenty of educational resources to help you learn, a wide range of trading tools, and several account types and platforms to choose from.

Use this link to open a free demo account at Admiral Markets. You don’t have to spend any money to learn how to trade through a demo account.

Admiral Markets Alternatives

| Minimum Deposit | Deposit Bonus | No Deposit Bonus | Islamic Accounts | |

| Binary.com | $10 | 20-100% | $20 | Yes |

| Olymp Trade | $10 | 50-100% | No | Yes |