Forex Strategies Revealed

Whether it’s equities trading or Forex trading, you must ensure a plan is in place. Trading without a plan is setting you up for a road of failure. In order to have long-term success in Forex trading, you need to understand what goals you want to accomplish and ensure your trading plan is built around those goals. This article will go over several different trading strategies and what they encompass. Everyone trades differently and it is important to understand all that is out there and with this, it’ll shed light on places where you can start.

Long Term Versus Short Term

Before you decide on a strategy you must ask yourself if you will be trading long term or short term. While some strategies work well on both time horizons, there are many that do not. Understanding your trade length will eliminate those strategies that may not work in your favor.

Short term trading is typically defined as trades that are a several minutes to a few hours, typically never lasting longer than a day. These provide the trader with potentially quick return on investment but all is higher in risk.

Long term trading are trades that typically last longer than 24 hours and are held to profit from larger swings in the market. Swing trading is popular in longer term trading and we’ll go over that later in this article.

Now that you’ve asked what style of trading you are wanting to build off of, let us being talking about the various strategies that are out there today.

Fibonacci Levels

If you have had exposure to the Forex market for any length of time, then you likely have heard of the Fibonacci levels and tools. The Fib tools are essentially different levels where a market could look for support or resistance. While there are several Fib tools out there, we will focus on the Fib retracement and Fib extension.

Fib retracement is used when the market has moved either up or down, and you as a trader are searching for there the market may bounce back to. To plot the tool, you will take from low to high, or high to low, and the tool will plot the Fib levels. For this trading strategy, traders typically look for support or resistance around the 0.618 level of the Fib retracement. Once the level is hit, many traders begin watching the market for a potential bounce off those levels. While this isn’t a given, many traders use this an alert to begin watching the market.

A Fib extension is a little different in that you are looking for the market to continue in a certain direction after a pull back in either both a bull or bear market. Also known as an ABC structure, see the example below for how the strategy works.

You take the lowest point of the market before it began the uptrend, noted by letter A. From there, you trace it up to where the market made a high, noted by letter B. Then you find the lowest point where it retraces, noted by letter C. Then you can look for the extension and in this example, the market extended up to the 0.786 levels and fell back. This can give you something to aim for if you believe the market will continue its extension to the upside or downside.

Swing Trading Strategy

Alluded to in the introduction, swing trading is extremely popular in the Forex market because this allows you to capture the more sizeable moves without need to focus on every five-minute move. Swing trading is simple in theory but a little more difficult to apply in practice.

How swing-trading works is you are simply attempting to time the market highs and lows and your entry/exit points, and profit of the longer timeframe moves. If you look at the example chart used in the Fib extension example, letters A to B would be the swing the move you are attempting to profit off of. There are several ways to help you predict this market move such as Stochastic indicators or using the moving averages as a potential alert.

This doesn’t tend to work all well in a shorter time frame as the market is moving quickly and with swing trading, you’re not as concerned with specific entry and exit points.

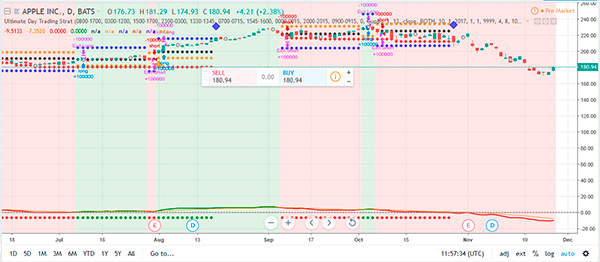

Scalping Strategy

For those looking for the quick intra day action, the scalping strategy is right up your alley. Scalping is when you enter and exit positions, looking to only maintain that position for a few minutes to a few hours to take a quick profit off of the directional movement. Now doing this once or twice may not yield much of a return, but the idea with this strategy is you are scalping multiple times over the course of a trading session. Scalping can be done on a few different time frames such as the one-minute, five-minute, and even ten-minute. This strategy can be quite risk but if done correctly, can yield quick returns.

To complement this strategy, you’ll need to pay attention to support and resistance levels, as well as having an indicator in place to help you better predict when to enter and exit trades. The indicators can the RSI, moving averages, or Stochastic.

Day Trading Strategy

This strategy is perfect for those who are not interested in scalping, but also not interested in holding positions longer than a day, associated with swing trading. Day trading is when you enter and exit a position within the same trading day. Now this could be one position in the morning and closing it in the afternoon, or a multiple positions throughout the day.

With the day trading strategy, you are looking to buy and sell, support and resistance levels that are intra day. Also, you are looking to profit off of market emotions such as larger pull back or larger market run-ups. With this strategy, you can utilize a larger time frame, such as a thirty-minute or an hour to see where the market is, but then use a five-minute chart to time your entry. This works well because it limits risk by holding a position overnight, but also gives you enough time for the market to move in your direction.

Indicators

Now that we’ve gone over a few popular strategies, it is important to understand the different indicators that can be used with each strategy. Remember, with many of these indicators you can manipulate the inputs, adjust what the indicator plots on your chart.

- First, there are the Bollinger Bands, which are three lines plotted as a channel that can help you potentially identify entry and exit points. These are usually one standard deviation apart from the middle line, giving you alerts as to when the market may shift. The inputs are adjustable to fit your needs, and many traders use this indicator.

- Next up are the moving averages, which can be set for nearly any time span you wish. However, the more popular ones are the 200-day, the 50-day, and then anywhere between the 5-day to 20-day. How these are used are typically when the shorter lengths cross over the longer lengths, this can indicate a shift in market direction. While this isn’t always the case, it alerts the trader to potentially pay close attention to that market.

- Lastly, there is the RSI or Relative Strength Index indicator that plots at the bottom of the chart. This indicator is derived from price and can alert you as to when a chart may be overbought or oversold. The indicator moves from 0 to 100, with anything over 70 being overbought and anything below 30 being oversold. Again, as with many indicators you can adjust the inputs to fit the timeframe you are currently trading.

Having a Plan for Success

While Forex can look intimidating to those who have never traded or are looking for a new market, as with any trading job you need to have a plan in place and by having a plan you will be better prepared. Forex affords you the ability to trade 24 hours a day 5 days a week, and you can trade multiple time frames.

The trading strategies laid out here are great places to start and get your feet wet with trading. Being by testing the strategies on a paper trading account so you don’t risk your hard earned capital. There are strategies for long term and short-term traders, and it is up to you to find what suites you best. Ensuring your indicators are adjusted to the correct time lengths to fit your trading and you should be good to go. Forex is one of the worlds most liquid and highly traded markets, giving you the ability to trade whenever. Also, ensure you have the proper platform and broker in place that fits your trading and your strategies needs. Without a plan, the Forex market is a place you will likely fail at and with these strategies you can look to mitigate that risk.