Tickmill Review

Tickmill Review

| Min. Deposit100$ | Demo AccountYes |

- Rating

- Spreads starting from 0.0 pips

- 84 trading instruments

- Max leverage of 1:500

- Negative balance protection and no requotes

Tickmill.com is a FX broker offering trading on a variety of instruments across asset classes such as stocks, bonds, commodities, and forex. The company has the following selling points to offer:

- Security – The broker maintains traders’ deposits in separate accounts at prestigious banks in compliance with the regulations of the Seychelles Financial Services Authority (FSA).• Excellent Trading Conditions – Tickmill offers excellent trading conditions featuring low commissions and spreads and no delays, interventions, or requotes.

- Recipient of Several Industry Awards – Tickmill is the recipient of several industry awards such as FxDailyInfo.com Broker Awards’ Top CFD Broker 2018, UK Forex Awards’ Best Forex Trading Conditions 2017, and the Global Brands Magazine’s Most Trusted Broker in Europe 2017.

- No Restrictions on Strategies – Traders are free to implement as many strategies as they wish, including arbitrage, scalping, and hedging. There is absolutely no limit to the profits they can make.

How Reliable Is This Online Broker?

Tickmill Group, the parent company of the Tickmill brand, has received several licenses as follows:

- Tickmill Limited (https://tickmill.com) is regulated by the Seychelles Financial Services Authority.

- Tickmill UK Limited (https://www.tickmill.co.uk) is regulated by the UK Financial Conduct Authority.

- Tickmill Europe Limited (https://www.tickmill.eu) is regulated by the Cyprus Securities and Exchange Commission.

The company is registered with the following:

- Financial Conduct Authority (FCA)

- Federal Financial Supervisory Authority (BaFin)

- Commissione Nazionale per le Societa e la Borsa (CONSOB)

- Autorite de Controle Prudential (ACPR)

- Commission Nacional del Mercado de Valores (CNMV)

In addition, Tickmill UK Limited is a member of the following compensation funds:

- Financial Services Compensation Scheme (FSCS) – An independent fund to compensate clients of licensed UK financial services, its objective is to pay compensation to the customers of trading services that have simply stopped functioning.

- Investor Compensation Fund – Its aim is to compensate the clients of trading services that are no longer able to function.

Tickmill Ltd offers excellent customer support through the following:

- Write to 3, F28-F29 Eden Plaza, Eden Island, Mahe, Seychelles

- Email to [email protected]

- Call the numbers +852 5808 2921 or +65 3163 0958

- Live chat

Tickmill Facts and Figures 2026

| Instruments | 100+ Forex, Oil, Crypto, Indeces, Bonds, Stocks, Precious Metals. |

| Licenses and Regulation | (FCA) UK, (FSA) Seychelles, (CySEC) Cyprus, (Labuan FSA) Labuan, (FSCA) South Africa. |

| Demo Account | Yes |

| Islamic Accounts | Yes |

| Trading Platforms | MetaTrader 4/5, MetaTrader WebTrader, MetaTrader Mac, CQG. |

| Minimum Deposit | $100 |

| Accounts | Over 550,000 registered accounts. |

| Customer Support | FAQ, Online Contact Form, Phone, Live Chat, Email. |

| Funding & Withdrawal | Bank Transfer, Visa, MasterCard, Skrill, Neteller, dotpay, paysafecard, sofort, Rapid. |

Guide to Opening an Account – Different Types of Accounts

Based on their trading skills and goals, traders can choose from the following accounts at Tickmill.com:

- Classic Account – You can use this account to access global markets and make commission-free trades.

- Islamic Account – Followers of Islam can enjoy the benefits of a swap-free account that fully complies with Sharia laws.

- Pro Account – This account, designed for professional traders, features competitive commissions and tight spreads.

- VIP Account – This type of account features ultra-low commissions.

- Demo Account – If you are a new customer who is not ready to invest real money, you can learn more about trading and polish your trading skills through a demo account. This type of account enables traders to test their strategies without taking any risks before they actually begin to trade for real.

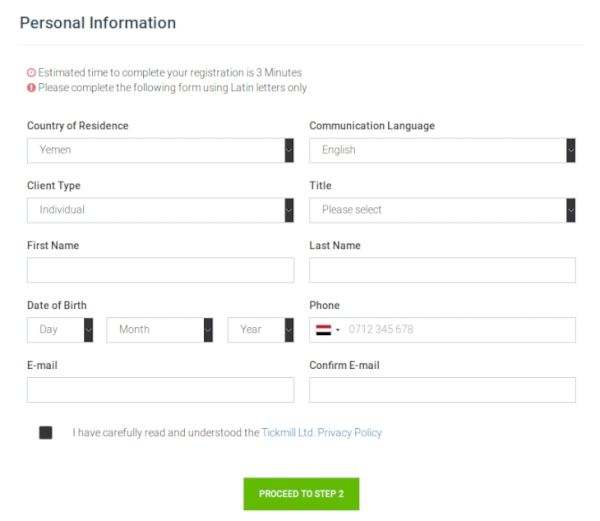

The following is the procedure to open an account at Tickmill.com:

- Click on the Create Account link on the website.

- This opens the online registration form, which takes only three minutes to fill.

- Select your country, client type (company or individual), language, title, and date of birth from the dropdown boxes.

- Enter your full name and email address.

- Read the privacy policy before checking the box against the declaration that you have carefully read and understood the Tickmill Ltd. Privacy Policy.

- Proceed to Step 2 of the registration procedure, in which you have to enter your address, confirm if you are a US citizen for tax purposes, level of education, employment status, and financial background.

- Answer some yes/no questions about your trading knowledge and experience.

- Input your IB code if you have one.

- Create a password and confirm it.

- Confirm that you would like to receive special offers and newsletter from the Forex broker.

- Confirm that you have read and understood the client service agreement and risk disclosure statement and that you agree with it.

- Finally click on the green Open Account button to create a new trading account.

Opening a demo account at Tickmill is a simpler procedure:

- Click on the blue Try Demo Account tab on the homepage.

- This opens a simple online registration form.

- Input your name, email address, and phone number.

- Input your virtual deposit amount.

- Choose from Classic account, Pro account, and VIP account.

- Choose from the currencies USD, GBP, EUR, and PLN.

- Choose from a leverage of up to 1:500.

- Finally click on the blue Submit button to create your demo account.

As the holder of a demo account, you can enjoy the following benefits:

- Access to real-life volatility and real-time prices

- Full-fledged MT4 trading platform

- Trading instruments that include gold and silver, bonds, WT1, 15 stock indices, 62 pairs of currencies

Trading Platforms

Tickmill gives traders the options of trading on their desktop browser or on the move with their tablets or smartphones.

You can choose from the following two platforms:

MetaTrader 4

Traders can fully customize their MT4 trading platforms according to their trading skills and goals. This platform has a user-friendly and feature-rich interface. It offers a trading environment that clients can fully customize to enhance their trading performance. They can easily access their portfolio and enjoy excellent order management tools and improved charting functionalities.

The MT4 platform owes its popularity to its support for MQL, a programming language that enables traders to program Expert Advisors (EAs) and indicators.

The key features of this platform include:

- No partial fills

- Availability of micro lots

- EA trading facilities

- CFDs on stock indices, forex, bonds, commodities, and WTI

You can download MetaTrader 4 for Windows, Web Trader, iOS, Android, and OS X.

Web Trader

If you are the type of trader who does not like to download and install software on your computer, you can use Web Trader, an online trading platform that gives you easy and fast access to trading. It is just as good as MT4, but there is no need to download and install any software.

Its features and benefits include:

- Customizable price charts

- 9 chart timeframes

- Basic analytical objects

- Real time quotes in Market Watch

- One-click trading

- Safe and secure

Trading Instruments

Tickmill provides a variety of trading instruments such as CFDs on stock indices, currency pairs, bonds, crude oil, and precious metals.

- Forex – Trade over 60 pairs of currencies.

- Stock Indices and WTI – Trade CFDs on crude oil and international stock indices.

- Precious Metals – Trade CFDs on precious metals such as silver and gold.

- Bonds – Invest on German government bonds featuring zero commission and competitive spreads.

Tools for Traders

Tickmill.com offers a number of tools to help its clients perfect their strategies:

- Autochartist – This is a powerful tool for technical analysis, capable of helping traders take their trading to greater heights.

- Forex Calendar – Forex traders can view indicators and significant economic events on the Forex Calendar.

- Myfxbook AutoTrade – You can use this tool to learn tried and tested strategies from professional traders.

- Tickmill VPS – This tool keeps signals and EAs running even when customers lose their Internet connection.

- One-click Trading – This is a tool that enhances the functionality of the MT4 trading platform.

- Forex Calculators – Use a variety of calculators such as pip calculator, currency converter, and margin calculator to save precious time.

Get Educated at Tickmill

Tickmill is not just an online broker, but also an educator. In other words, it is not just a place for trading, but also a place for getting educated, honing trading skills, and testing new trading strategies.

- The broker offers a wide range of resources, such as the following:

- Webinars

- Forex glossary, which explains important trading terms

- Seminars

- Free eBooks on trading ideas, insights, and strategies

- Video tutorials

- Infographics

- Educational articles

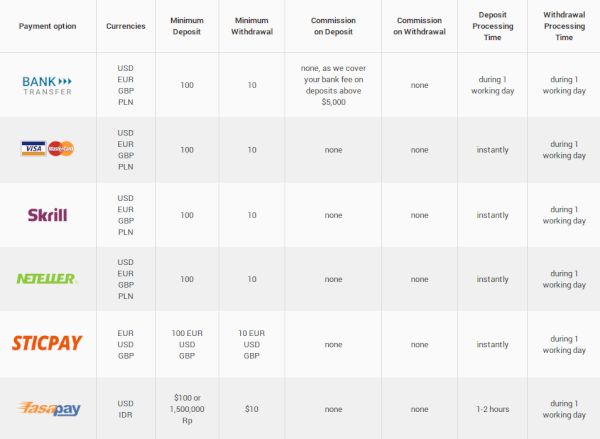

Banking Information – Making Deposits and Withdrawals

Clients can easily deposit, withdraw, or transfer funds using a payment method that works best for them. Tickmill does not charge fees for deposits starting from US$5000 or its currency equivalent. It covers transaction fees up to US$100 if traders email copies of their bank statement or any other supporting document within 30 days of making the deposit.

Tickmill offers the following payment methods:

- Bank Transfer

- Visa & MasterCard

- Neteller

- Skrill

You can deposit a minimum of $100 and withdraw a minimum of $10 using the above methods. The deposit and withdrawal processing time – 1 (one) day.

The following payment methods are available only for clients registered at Tickmill Ltd Seychelles:

- Fasapay

- UnionPay

- NganLuong.vn

- Qiwi Wallet

- Globepay

- Thailand online bank transfer

- Vietnam instant online bank transfer

Here are a few terms & conditions related to banking at Tickmill.com:

- The company only accepts deposits made through payment methods that belong to their clients, not to any third party.

- Tickmill does not charge transfer fees for using its payment methods.

- It is not responsible for fees charged by electronic wallet services and banks.

- The broker processes payouts to the same banking method used to make deposits.

- Tickmill.com processes payouts only in PLN, USD, GBP, and EUR.

- If customers make deposits and withdrawals and do not make enough trades, the Forex broker may freeze their accounts.

FAQ

Which trading platforms are supported by Tickmill?

MetaTrader 4/5, MetaTrader WebTrader, MetaTrader Mac, CQG.

What is the minimum deposit required to open an account with Tickmill?

100 USD.

Final Thoughts on Tickmill

Compared to online brokers who have been around for years, Tickmill is rather new. But it has clients who have been loyal to its services for the past several months and they are quite satisfied with its services. If you don’t want to risk money at Tickmill right away, you can get started with a demo account. If you don’t know much about trading, Tickmill will teach you the basics of trading.

We encourage you to check out Tickmill for yourself by clicking on this link. Opening a demo account is fast, risk free, and absolutely free of charge.

Tickmill Alternatives

| Minimum Deposit | Deposit Bonus | No Deposit Bonus | Islamic Accounts | |

| Binary.com | $10 | 20-100% | $20 | Yes |

| Olymp Trade | $10 | 50-100% | No | Yes |